Business Tax Id Ohio

Businesses in Ohio and all other states primarily use the Employer Identification Number for filing taxes. All business taxpayers must be registered with the Ohio Department of Taxation.

Starting A Business Ohio Secretary Of State

This individual will be responsible for direction controlling and managing the entities funds and assets.

Business tax id ohio. An EIN is to your Ohio LLC what a Social Security Number is to a person. Ohio liquor permit number if applicable. All Ohio Tax ID EIN application must disclose the legal name and the Taxpayer Identification Number SSN or ITIN of the principal officer.

Business address update Changing your business address. The departments toll-free business taxpayer assistance line is 888 405-4039. Perhaps one of the most important tasks a business owner can complete is receiving their Ohio EIN or tax ID number.

FEIN or SSN is required for CAT Business name. This unique number assigned by the IRS identifies the business for Internal Revenue Service purposes and is also required for other business-related matters. The entity names used as examples are not necessarily in our records but used only as possible search terms or results.

What Ohio Tax ID Do Businesses Use. Given the private nature of EINs there is no simple way to access them regardless of the state in which the business operates and Ohio. Some major cities such as Columbus also require you to file city taxes at the end of the year.

While were on the subject of taxes you should also know that Ohio forces businesses to pay excise taxes. It is a federal identifier issued by the IRS. If you are concerned with how to get a tax ID number in Ohio GovDocFiling offers services that help make this process simple and less time consuming.

How to search for business names. Although Ohio also issues other identifiers the EIN is the most common method of uniquely identifying a business. The department also maintains a complete.

All businesses including home businesses eBay online web sites professional practices contractors or any other business in Ohio are required to identify their business with one of two numbers. The department offers two methods to accomplish this - through the Ohio Business Gateway or by paper application. Either a Social Security number or an EIN also called FEIN if it is a Federal Tax Id Number or employer identification number.

A Tax ID EIN is used for opening a business bank account filing business tax returns and in many cases is required when applying for business licenses. This informational guide has been created to assist you in searching the Secretary of States Corporations Business Entity database. Issued by the Division of Liquor Control Primary business location and business mailing address.

Your Ohio tax ID number allows you to open an official business bank account hire employees and file taxes. Getting a tax ID is a way of registering your business with the government at which point youll obtain a unique string of numbers- almost like a social security number SSN- tied to your business. Business Address - The physical.

In most cases it is helpful to. IRS small business newsletter This weekly electronic newsletter offers useful tax information for business owners such as deadlines tips and whats new for federal taxes. If you and your business partners are ready to get a tax ID number in Ohio also referred to as an employer identification number or EIN you can obtain it at any time.

You can use the Ohio Secretary of States business search to see if a business is registered to do business in Ohio. If your business makes more than 150000 in the state of Ohio or if you have total receipts over 1 million you may be responsible for paying Ohio-specific taxes. Obtain your Tax ID in Ohio by selecting the appropriate entity or business type from the list below.

When starting a business in Ohio serving as the administrator or executor of an estate creator of a Trust or operating a Non Profit Organization obtaining a Tax ID EIN is a key responsibility. The EIN is a separate number that is used to federally register a business with the Internal Revenue Service IRS and may be needed in addition to state tax numbers. Business tax numbers in Ohio are often confused with the Employer Identification Number.

A Tax ID EIN is used for opening a business bank account filing business tax. Once your application has been submitted our agents will begin on your behalf to file your application and obtain your Ohio Tax ID. Federal employer ID number FEIN SSN or Ohio tax account.

Your state tax ID will be used to keep track of these figures so you can pay appropriately at the end of the year. A Tax ID also known as an Employer ID Number EIN is a unique nine digit number that identifies your business or entity with the IRS for tax purposes essentially like a Social Security Number for the entity. After your Tax ID is obtained it will be sent to you via.

A Tax ID also known as an Employer ID Number EIN is a unique nine digit number that identifies your business or entity with the IRS for tax purposes essentially like a Social Security Number for the entity. An EIN Number stands for Employer Identification Number and it will be issued by the IRS to your Ohio LLC. It helps the IRS identify your business for tax and filing purposes.

Register for Taxes through the Ohio Business Gateway or by paper application. Identification and relationship to business. Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the drop-downs and then click the Search button.

Complete this form and send it to us. Tax law guide and Tax Id Number.

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

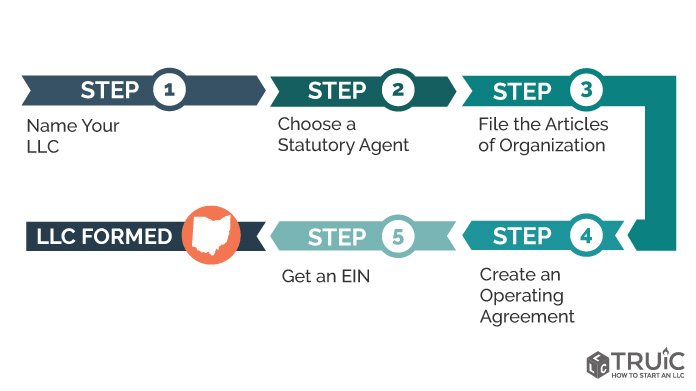

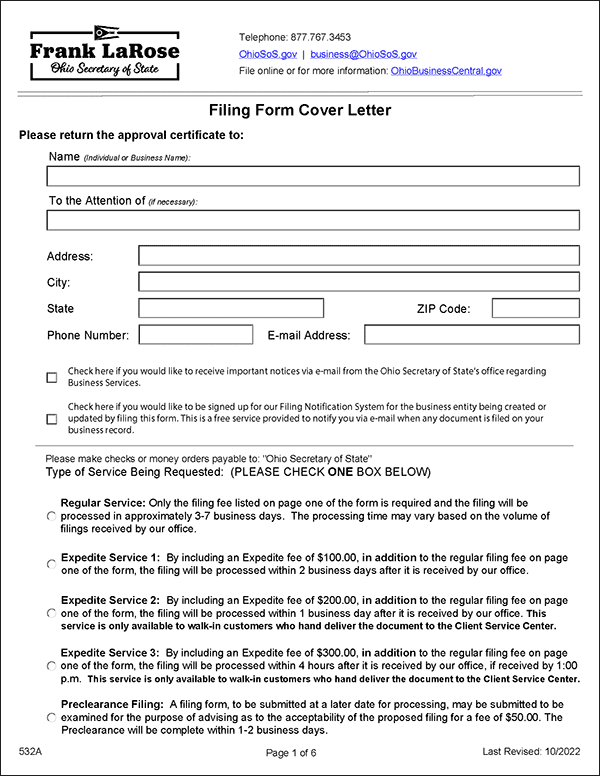

Llc Ohio How To Start An Llc In Ohio Truic

Https Ohio Edu System Files Sites Finance Purchasing Ohio Tax Exemption Certificate Pdf

Sales And Use Tax Electronic Filing Department Of Taxation

Llc Ohio How To Start An Llc In Ohio Truic

Step By Step Guide To Forming An Llc In Ohio Startingyourbusiness Com

Ohio I File Taxpayer Identification Number

![]()

Llc Ohio How To Start An Llc In Ohio Truic

Income Tax City Of Gahanna Ohio

State Of Ohio Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Llc Ohio How To Start An Llc In Ohio Truic

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

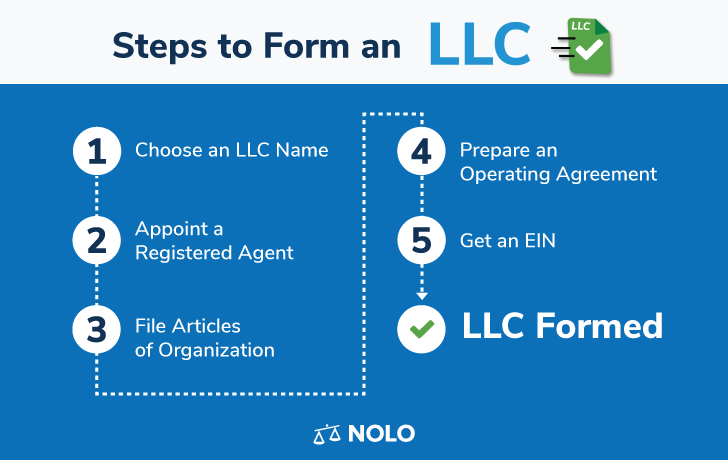

Llc In Ohio How To Form An Llc In Ohio Nolo

Verify A Refund Check Department Of Taxation

Step By Step Guide To Forming An Llc In Ohio Startingyourbusiness Com

Verify A Refund Check Department Of Taxation

Posting Komentar untuk "Business Tax Id Ohio"