Corporate Tax Id Ontario

Two letters and four digits attached to a business number and used for specific business activities that must be reported to the CRA. It is based on information that has been filed by the corporation and stored in ONBIS Ontario Business Information System Ontarios Public Record of corporate information.

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Corporate tax id ontario.

Corporate tax id ontario. This number is required to file your Corporations Information Act annual return. Your corporation income tax program account will include the letters RC and a four-digit reference number. 1 866 ONT-TAXS 1 866 668-8297 Fax.

Have a copy of your certificate of incorporation on hand because we may ask you for it. If you need your BN before you receive the confirmation notice call us at 1-800-959-5525. Corporation income tax program account.

In most cases new corporations will automatically receive a BN from the CRA within 45 days of incorporating at the federal or provincial level. The Ontario small business deduction SBD reduces the corporate income tax rate on the first 500000 of active business income of Canadiancontrolled private corporations CCPCs. Ontario corporation number and Ontario corporations tax account number.

It is unique to your organization and is used when dealing with the federal government and certain provincial governments. This return must be. Ministry of Finance 33 King Street West Oshawa Ontario Canada L1H 8H5 The Honourable Peter Bethlenfalvy Minister of Finance 7 Queens Park Crescent 7 th floor Toronto Ontario M7A 1Y7.

The Corporation Document List identifies all documents filed since June 27 1992 by an Ontario corporation or an extra-provincial corporation carrying on business in Ontario. Corporations subject to Ontario income tax may also be liable for corporate minimum tax CMT based on adjusted book income. Search by Business Number BN Enter the first nine-digit of the fifteen-digit Business Number BN that was assigned to the federal body corporate by the Canada Revenue Agency CRA.

This number is your identification number with the Canada Revenue Agency and is utilized when filing your corporate income tax return. For Canadian-controlled private corporations claiming the small business deduction the net tax rate is. For tax years ending after December 31 2008 you are required to file a Schedule 546 Corporations Information ActAnnual Return for Ontario Corporations with the Canada Revenue Agency together with your T2 Corporation Income Tax return.

The CMT rate is 27 and applies when total assets are at least CAD 50 million and annual gross revenue is at least CAD 100 million on an associated basis. Canada Revenue Agency CRA program accounts. 9 effective January 1 2019.

In order to be processed by the Ontario Ministry of Finance your Corporations Information Act Annual Return must be received at the Ontario Ministry of Finance by September 30 2009. The CMT is payable only to the extent that it exceeds the regular Ontario income tax liability. This certificate is issued based on information recorded in the Ontario Business Information System ONBIS on or after June 27 1992 when a corporation has not filed under the Corporations Information Act.

10 effective January 1 2018. All calls regarding these taxes should be directed to the Ontario Ministry of Revenue at 1. If you need your BN before you receive the confirmation notice call us at 1-800-959-5525.

You can use Schedule 500 Ontario Corporation Tax Calculation to calculate your Ontario basic income tax. Understanding the differences. For tax years ending on or after January 1 2009 Ontario corporations and foreign business corporations licensed to carry on business in Ontario.

1 866 888-3850 TTY. Ontario Corporation Number OCN or Business Identification Number BIN Accurate spelling of the corporations name the business name limited partnership or the corporations operating name CPVSB recommends that clients conduct both corporate and BNLP Enhanced Business Name searches when they are uncertain as to whether the name belongs to a corporation or an. 12 Zeilen The basic rate of Part I tax is 38 of your taxable income 28 after federal tax abatement.

This is a sample from Ontario Incorporation documents. As of October 1 2009 it will no longer be possible to file the Corporations Information Act Annual Return with MOF. Premium taxes mining tax transfer tax and the payment in lieu tax.

After January 1 2009 the Ontario Ministry of Revenue will continue to be responsible for corporate taxes not transferred to the CRA including. All registered corporations require a corporate income tax number. A unique 9-digit number and the standard identifier for businesses which is unique to a business or legal entity.

The business number is a nine-digit number the Canada Revenue Agency CRA assigns your business or nonprofit as a tax ID. Additional historical information may exist on the Central Production and Verification Services Branch corporate microfiche. Certain business activities require a business number.

After the general tax reduction the net tax rate is 15. On line 270 of Schedule 5 Tax Calculation Supplementary Corporations enter the amount of basic income tax calculated. For corporations that are filed manually the corporate number is located in the top right hand corner of the first page of Articles of Incorporation.

A tax ID number is used to identify different kinds of taxpayers while a corporate number is used by limited liability companies LLCs or other corporations. Learn why you might need one and how you could utilize it when accessing various CRA programs. The Ontario corporation number is issued by the Ontario Ministry of Government and Consumer Services.

Schedule 500 is a worksheet and you do not have to file it with your return. Ontario Budget information. Effective January 1 2020 the lower rate of Ontario corporate income tax.

For corporations that are filed electronically the corporation number is located near the middle of the page under the corporation name.

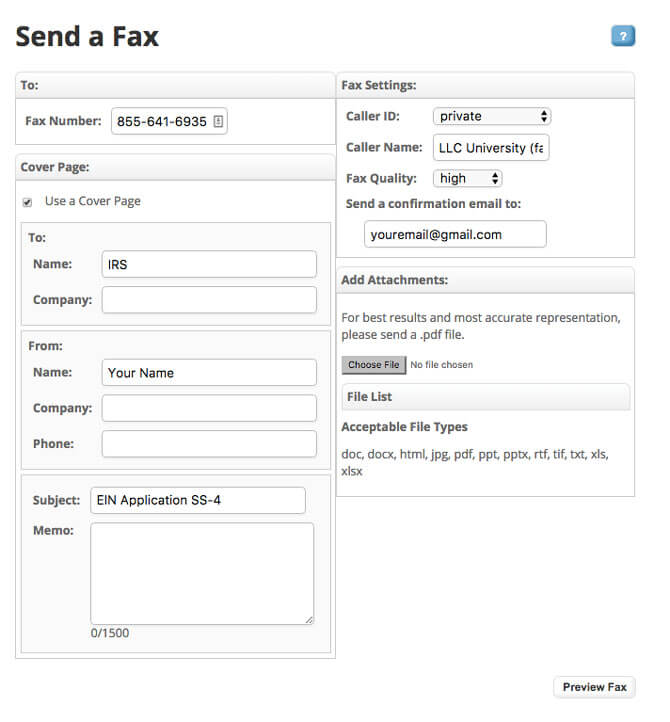

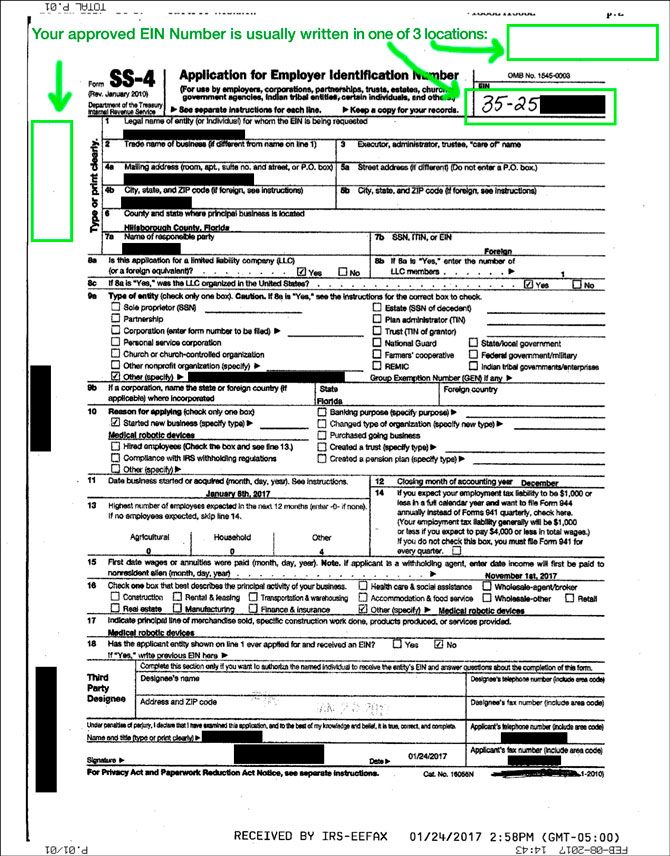

Applying For Ein Without Ssn Or Itin For An Llc Llc University

3 11 16 Corporate Income Tax Returns Internal Revenue Service

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

Https Www Rbcdirectinvesting Com Pdf Rc521 Guide Pdf

Employer Identification Number Ein For Canadian Companies Madan Ca

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Lettering

Federal Business Number Gst Hst Payroll Import Export Resources For Canadian Business Owners

Tax Identification Numbers Us And Canadian

How Do I Find My Business Number Accessoci

Applying For Ein Without Ssn Or Itin For An Llc Llc University

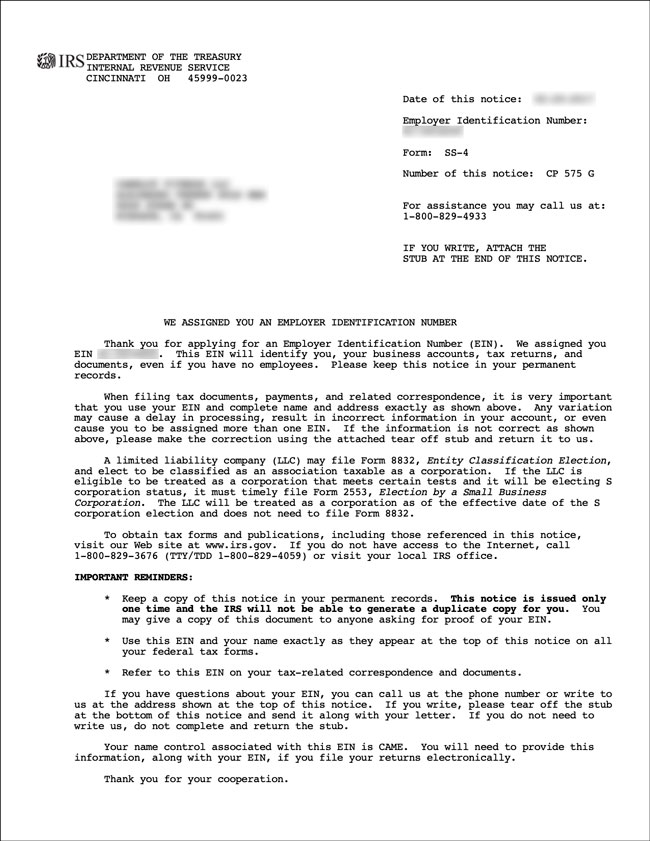

Letter Ein Confirmation Confirmation Letter Doctors Note Template Employer Identification Number

Employer Identification Number Ein For Canadian Companies Madan Ca

What S My Property S Tax Identification Number

U S Tax I D Numbers Itin For Canadians Madan Ca

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Applying For Ein Without Ssn Or Itin For An Llc Llc University

Register For Vat In Canada Updated For 2021

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Posting Komentar untuk "Corporate Tax Id Ontario"