Llc Tax Filing Deadline 2021 California

According to FTB 3556 the 800 tax is waived if no business is conducted during the 15 days and the LLC is filed. A final return for an account reporting on a yearly basis covers the period from January 1 through the date the business is discontinued.

California Sales Tax Small Business Guide Truic

You must specify the quarter on the report or deposit.

Llc tax filing deadline 2021 california. The due date with extensions for filing the donors estate tax return. Do not mail your Payroll Tax Deposit DE 88DE 88ALL with the DE 9 and DE 9C to avoid delays in processing. Pay the 800 annual tax By the 15th day of the 4th month after the beginning of the current tax year.

Use LLC Tax Voucher 3522 when making your payment and to figure out your due date. Partnership tax returns on Form 1065. The statement must be filed within 90 days after the filing of its original Articles of Incorporation and biennially thereafter together with the Statement of Information Form SI-100 filed pursuant to Corporations Code section 8210.

Franchise taxes are due within 75 days of creating your LLC. S corporation returns on Form 1120 S. LLCs are basically subject to the same 15-day rule.

If the donor died during 2020 Form 709 must be filed not later than the earlier of. January 15 2021 2020 fourth quarter estimated tax. The final return must be filed and the taxes.

Doing business in California. 15th date is due to the 15-day rule. Alternatively you can re-file it now but use a future file date aka LLC effective date of January 1st 2021.

California grants an automatic 6 month state tax extension for LLCs to file their return. Also known as CA Form 3522 Form 3522 is a Tax Voucher used to pay the annual LLC tax of 800 for the taxable year 2021. California Multi-member LLCs must file their LLC tax return FTB Form 568 by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers.

The full 800 is due come tax season. If it takes longer than 1152021 then youll owe a franchise tax payment for 2021 the Jan. If your LLC meets one or more of the following conditions.

It is important that you file the return and pay any taxes due on time to avoid penalty and interest charges. Also regardless of whether or not a business is fully in operation for an entire year doesnt matter. For any LLC formed in California in 2021 2022 or 2023 there is a one-year exemption-- available for the LLCs first taxable year -- from California states 800 minimum annual franchise tax.

Extension to file can be accomplished by extending the deadline for fling tax return or by filing Form 8892. California doesnt prorate for a portion of the year so even if an operating year is less than 365 days the tax amount is still 800. Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021.

For example if youre submitting in 2021. CA tax owed is 12590 800 LLC Tax plus an 11790 LLC fee if the income is more than 5000000. If an existing foreign limited liability company registers or begins doing business in California after the 15th day of the fourth month of its year the annual tax is due immediately upon registration or beginning to do business here.

If the street address of the associations onsite office or the street address of the responsible officer or managing agent of the association changes a corporation must file. Then you can wait until January 1st 2021 to file the new LLC. Youre required to pay an annual fee.

Your California LLC will also need to file a final tax return if its cancelled in 2020 or by 1152021. Just about all California LLCs and out of state LLCs that do business in California must pay the 800 a year franchise tax -- whether or not they did business or lost money. Multiple-member LLC returns filing partnership returns on Form 1065.

Starting in the second taxable year all LLCs would be subject to the annual 800 annual minimum franchise tax until they formally dissolve. Extension of time to file is available. The 800 minimum tax would not be due until 2022.

When the due date falls on a weekend or holiday the deadline to file and pay without penalty is extended to the next business day. Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021. The IRS announcement states that taxpayers can still obtain extensions to file their 2020 income tax return until October 15 2021 by filing a Form 4868 before the May 17.

These taxes are due every year and the amount is higher if your businesss income is more than 250000. Sole proprietorship and single-member LLC tax returns on Schedule C with the owners personal tax return. Then your LLC must.

The amount will be based on total income from California sources. Or April 15 2021. Visit the LLC Fee chart to figure your fee amount.

January 1 2021 is the first day of its first tax year. If you are required to file on a yearly reporting basis and you sell or discontinue operating your business then you are required to file a final tax return. Meets the requirements of Californias 15-day rule and will not need to file a California tax return for 2020.

If not then the LLC owes franchise tax for 2021 and will also need to file a final tax return in 2022. 15th day of the 4th month after the beginning of your tax year. Registered with the SOS.

This just means you file the LLCs Articles of Organization now but the new LLC wont go into existence until 2021 therefore taking advantage of Assembly Bill 85. Schedule K-1s for partners in partnerships LLC members and S corporation shareholders on their personal tax returns. Every LLC formed or registered to do business in or doing business in the State of California must file 2021 Form 3522 with the California Franchise Tax Board every year.

The date format for reporting and making deposits is the last 2 digits of the year and then one digit for each quarter.

California Tax Deadline 2021 State And Local Taxes Zrivo

Monday Is The U S Tax Filing And Payment Deadline

California Income Tax Returns Can Be E Filed Now Start Free

California S 15 Day Rule For Corporations And Llcs Lawinc

California Ftb Rjs Law Tax Attorney San Diego

Where Do I Mail My California Tax Return Lovetoknow

Franchise Tax Board Announces Extended Time To File And Pay For California Taxpayers Affected By Covid 19 Pandemic Conejo Valley Guide Conejo Valley Events

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Federal And State Tax Payment Deadlines Extended To July 15 The Santa Barbara Independent

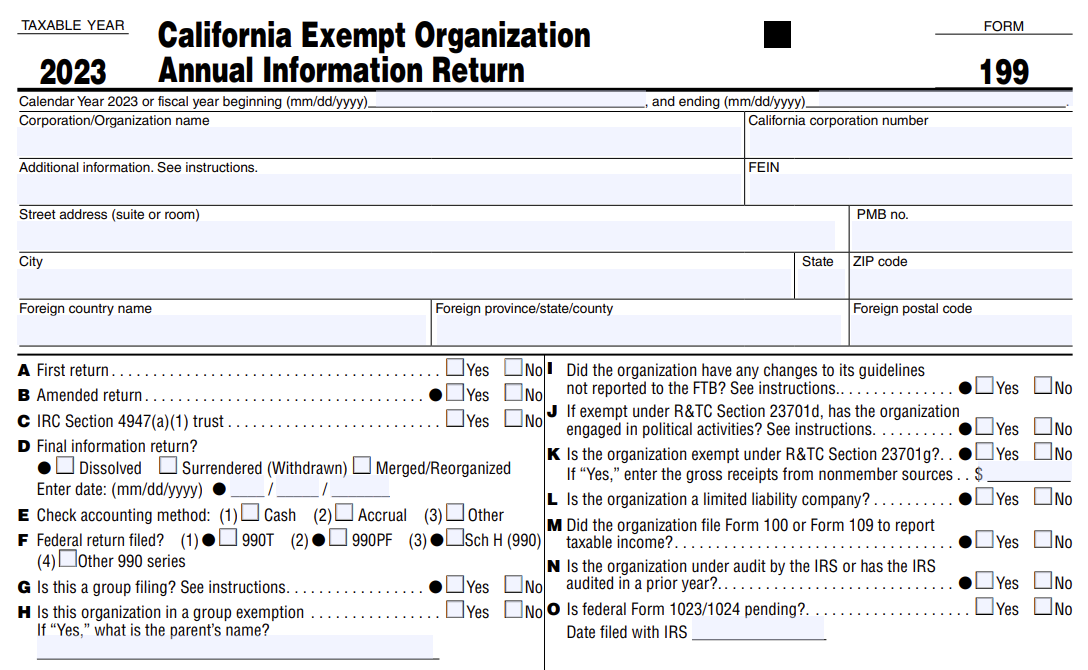

E File Ca Form 199 Online 2020 Form 199 Filing

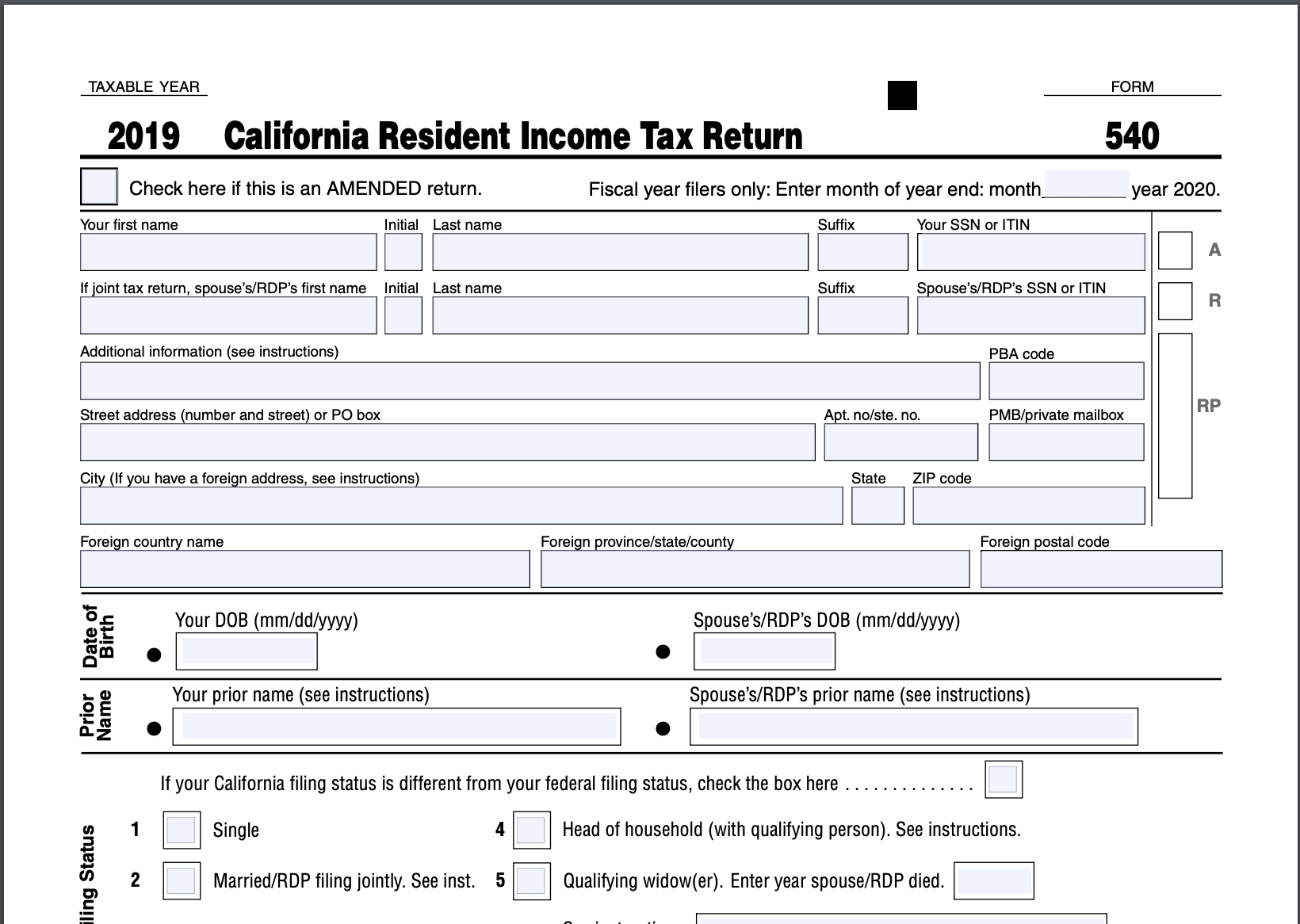

Irs Form 540 California Resident Income Tax Return

Some Tax Pros Want An Extension Of The Tax Year Cpa Practice Advisor

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

California Tax Deadline 2021 Tax Extension Mbafas

![]()

Llc California How To Start An Llc In California Truic

Posting Komentar untuk "Llc Tax Filing Deadline 2021 California"