Business Tax Id Kentucky

If you need a companys CBI for tax purposes you can get it directly from the business. So if you apply for a Kentucky state tax ID number with us whether it is a state Kentucky state tax ID number or you are applying for a Kentucky Kentucky state tax ID number click here to select state first.

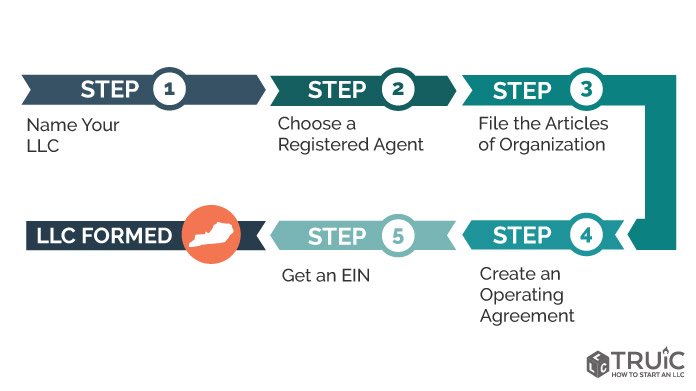

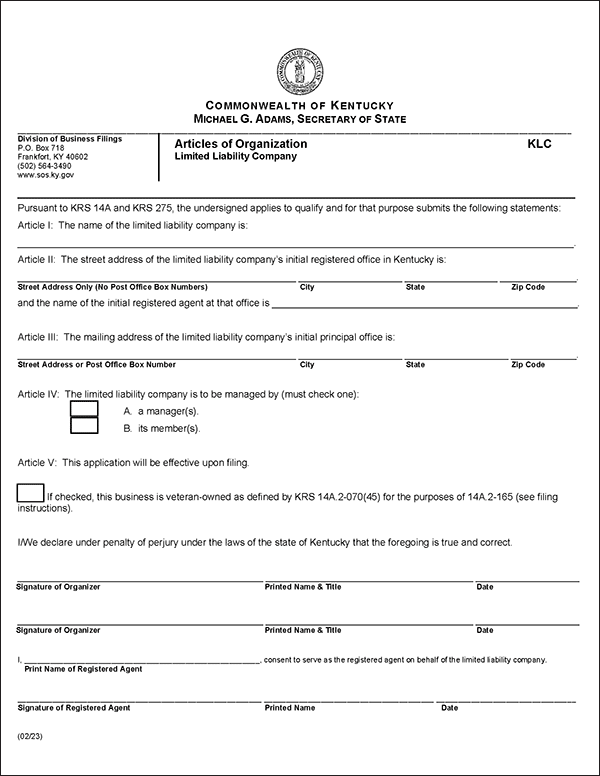

Kentucky Llc Start An Llc In Kentucky For 30

Even for businesses and entities that are not required to obtain a Tax ID EIN in Kentucky obtaining is suggested as it can help protect the personal information of the individuals by allowing them to use their Tax ID.

Business tax id kentucky. Getting a Tax ID is Easier Than You Think. When starting a business in Kentucky serving as the administrator or executor of an estate creator of a Trust or operating a Non Profit Organization obtaining a Tax ID EIN is a key responsibility. Additonally I was wondering where to get a Stanton Home Based Business.

The CBI allows the business to be easily identified by all state agencies that utilize the Kentucky OneStop Portal. But theyre necessary evils especially in the early. Obtaining a Kentucky Tax ID EIN is a process that most businesses Trusts Estates Non-Profits and Church organizations need to complete.

Either a Social Security number or an EIN or employer identification tax id number. However no matter which form you choose a Kentucky tax ID number is an important first step to establish a business identity separate from your personal one. Have W-9 Employees in Kentucky Operate a Kentucky Corporation or Partnership.

A Kentucky Tax ID EIN Number is needed for most businesses and organizations. Once your application has been submitted our agents will begin on your behalf to file your application and obtain your Kentucky Tax ID. If you do not already have a One Stop user account you will need to create one.

The Kentucky Business One Stop allows you to file the form online in a fast free and convenient way. The Kentucky Business One Stop website also offers an in-depth overview of taxes federal state and local required of businesses operating in the Commonwealth including. There is a fee for our services.

Three steps to obtain your Kentucky Small Business Tax ID EIN 1. A Tax ID also known as an Employer ID Number EIN is a unique nine digit number that identifies your business or entity with the IRS for tax purposes essentially like a Social Security Number for the entity. When you think about being the owner of your own enterprise you probably dont daydream about paperwork and government forms.

How To Get a Tax ID Number in KY Follow these steps using the online EIN application. A unique ten-digit number assigned to all Kentucky businesses. Once you have signed into the portal you will need to use the Link My Business option to gain access to your business.

The Department of Revenue does not administer local occupational net profits or gross receipts taxes. This document allows a business owner to register for the most common tax types for Kentucky businesses. To obtain general information regarding the major business taxes click the links below.

Click here to access the online portal. Obtain your Tax ID in Kentucky by selecting the appropriate entity or business type from the list below. The first step in actually launching a new business is generally to apply for a tax ID number Kentucky also called an employer identification number EIN.

Complete the online registration via the Kentucky Business OneStop portal. Enter your business information - Using our simple form fill out your businesss background and contact information. If your business or organization fits any of the below characteristics you will need a Kentucky Tax ID EIN.

Federal Tax Registration Requirements - In addition to obtaining an EIN the federal tax identification number for a business it is important for business owners to understand federal tax obligations. If you are not already utilizing the Kentucky Business One Stop Portal but would like to click here to access the portal. Tax ID for Wood Working business in Stanton KY Registration Wood Working Tax ID Registration in Stanton KY Home Based Business Get Home Based Buisness License Stanton Ky 40380.

Complete your order - Finish by completing your order form and submitting payment over our secure servers. Most businesses should have completed a Kentucky Department of Revenue Tax Registration Application in Step 2 of the Start page on Kentucky Business One Stop. For more information and to register visit the Start section of the Kentucky Business One Stop.

Sales Use Tax applies to businesses operating as a wholesaler retailer or seller in Kentucky. You may also be able to find a CBI in. After your Tax ID is obtained it will be sent to you via e-mail and will be available for immediate use.

Commonwealth Business Identifier CBI. Most types of businesses in Kentucky are required to register with the Department of Revenue. Your federal tax ID is sometimes referred to as a general tax ID You may also hear it called an employer identification number or EIN.

Your business needs to have a Kentucky CBI number which stands for a Commonwealth Business Identifier. Limited Liability Entity Tax. Should you have any questions concerning any local tax please contact the appropriate local official indicated at the Kentucky Occupational License Association.

In Kentucky state tax identification numbers for companies are called commonwealth business identifier numbers or CBIs. A Kentucky state tax ID number for a business or a business Kentucky state tax ID number is not free when you use our service to obtain it. However this is distinct from your federal tax ID.

A Tax ID EIN is used for opening a business bank account filing business tax. When Starting a Business all businesses including home based businesses internet businesses ebay online web sites professional practices contractors or any other business in Kentucky are required to identify their business with one of two numbers. Starting my own Powell County.

How do you apply. Uses of Kentucky Tax ID EIN Numbers. Select your business type - Select your type of business in our easy-to-use online tool.

Get Home Based Buisness License Stanton Ky small new business.

Kentucky Homestead Exemption Fill Online Printable Fillable Blank Pdffiller

Https Revenue Ky Gov Dor 20training 20materials Natp 202018 20kentucky 20state 20tax 20update Pdf

Https Revenue Ky Gov Forms 42a003515 Pdf

Kentucky Llc How To Start An Llc In Kentucky Truic

![]()

Kentucky Llc How To Start An Llc In Kentucky Truic

Http Www Kyagr Com Marketing Documents Kyp Buylocal Restaurants Pdf

Https Revenue Ky Gov Forms 42a003515 Pdf

Https Revenue Ky Gov Forms 42a003515 Pdf

Kentucky Llc How To Start An Llc In Kentucky Truic

Kentucky Tax Id Ein Number Application Guide Tax Id Ein Application Service Zoom Filings

Kentucky Unemployment Forms Fill Online Printable Fillable Blank Pdffiller

Https Revenue Ky Gov Forms 72a300 Pdf

How To Register For A Sales Tax Permit In Kentucky Taxvalet

How To Get A Resale Certificate In Kentucky Startingyourbusiness Com

Kentucky Department Of Revenue Notice Letter Sample 1

Https Revenue Ky Gov Forms 42a003515 Pdf

Kentucky Business License How To Get A Business License Truic

Posting Komentar untuk "Business Tax Id Kentucky"