Tn Business Tax Due Date 2021

67-6-504 and 505. An electronic return is considered timely filed if it was.

Tennessee S Tax Free Weekend 2021

BUS-26 - Uploading a CSV File with a Business Tax.

Tn business tax due date 2021. Original deadline for C Corporations and individuals. Apr 13 2021 The due date is Monday April 16 if April 15 falls on a Sunday. Tennessee Taxpayer Access Point TNTAP Find a Revenue Form.

Add these tax-filing dates to your 2020 calendar. Depending on the type of business you own your business taxes for the 2020 tax year are likely due May 17 2021. Quarterly filers must file by the 20th day of the month following the end of the quarter.

Due Date Extended Due Date. This expiration date may be adjusted if holidays and. BUS-19 - Business License Expiration.

6152021 - Business Tax Due Date - Annual filers with Fiscal YE 2282021. Business Tax Return Due Dates. If you decide to close your business you must file a final business tax return with the Department of Revenue within 15 days of closing and pay any tax that is due minimum of 22.

Business Tax Due Date 2021 TennesseeTennessee sales tax returns are always due the 20th of the month following the reporting period. Q3 Jul - Sep October 20. Your business tax return is due on the 15th day of the fourth month.

Businesses holding minimum activity licenses that do not file tax returns should notify local city and county officials or the Department of Revenue that the business is closed. Due May 15 2020. Taxes are due and payable the first Monday of October each year.

BUS-23 - Closing a Business Tax Account. This includes the October 15 2021 due date for filing 2020 income tax returns that were extended the original due date was May 17 2021. Most state income tax returns are income tax returns must be postmarked on or before the 2021 filing due date to avoid penalties and statewide business closures due to covid may impact your ability to prepare and file income taxes.

Original deadline for exempt organizations. The due date is Tuesday April 16 if Monday April 15 is a legal holiday. Get My Tax Questions Answered.

Due March 16 2020. Date of February 8th would be due June 15th and one filed with a period end date of February 25th would also be due June 15th. Find Tax Collections Information.

For example taxpayers whose tax year ends on December 31 each year will be issued licenses that expire on May 15 of the year following the tax period. 2019 Business Tax Deadlines for 2019 Tax Filing. Pay a Tax Bill.

2021 Sales Tax Holidays Information Here. BUS-25 - Addressing a Notice of Assessment for Business Tax. The due date is Monday April 17 if April 15 falls on a Saturday.

Estimated payments due on April 15 2021 are not included in this extension. Due April 15 2020. Taxes for 2021 become delinquent on March 1 2022.

Tax Return Due Dates for 2020 Small Business Taxes. These estimated payments are still due on April 15. 4152021 - Franchise Excise Tax all entities except Single Member LLCs Owned by an Individual Only.

Are you a small-business owner. BUS-24 - Business Tax Liabilities for Taxpayers that Obtained a Business License and Closed or Never Opened a Business. Tennessee storm and flood victims will also get more.

The deadline to pay taxes is the last day in February of the following calendar year. Q2 Apr - Jun July 20. Original deadline for partnerships and S Corporations.

Business licenses expire 30 days after the due date of the tax return for the businesss tax year. Schedule an Informal Conference. 6152021 - Business Tax Due Date -.

BUS-22 - Business Tax Due Dates. When Are Business Taxes Due in 2021. Annual filers must file by January 20th yearly.

Register a Business Online. For example taxes for the 2021 year become due in October of 2021 and must be paid by midnight CST February 28 2022. Q4 Oct - Dec January 20.

IR-2021-112 May 14 2021 Victims of this springs storms and tornadoes in Tennessee will have until August 2 2021 to file various individual and business tax returns and make tax payments the Internal Revenue Service announced today. Please note that if a due date falls on a weekend or holiday the date is extended through the next business day. Q1 Jan - Mar April 20.

10 Zeilen Due Dates.

![]()

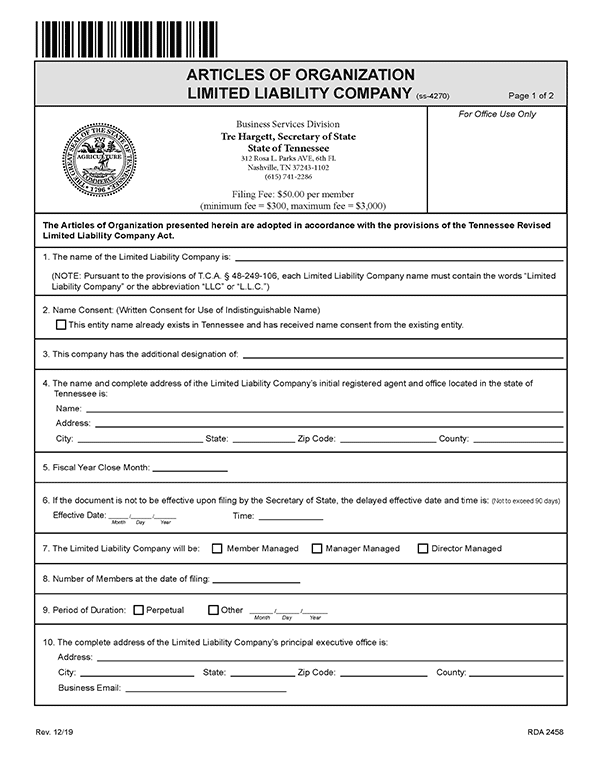

Llc Tennessee How To Start An Llc In Tennessee Truic

Tennessee Department Of Revenue Home Facebook

New Tennessee Laws To Be Enacted July 1 2021 Tennessee Senate Republican Caucus

Tennessee Sales Tax Filing Due Dates For 2021

Tennessee Sales Tax Small Business Guide Truic

Llc Tennessee How To Start An Llc In Tennessee Truic

Tennessee Department Of Revenue Home Facebook

Tennessee Department Of Revenue Announces Three Sales Tax Holidays Clarksville Tn Online

Tax Return Information For Tennessee Hall Form Inc 250

Tn Dept Of Revenue Tndeptofrevenue Twitter

Llc Tennessee How To Start An Llc In Tennessee Truic

Tennessee Tax Forms 2020 Printable State Tn Inc 250 Form And Tn Inc 250 Instructions

Where S My Tennessee Tn State Tax Refund Taxact Blog

Tn 3 Day Sales Tax Holidays Food Gun Equipment School Supplies 2021 2022 Schools Open House Dates Smokey Barn News

Posting Komentar untuk "Tn Business Tax Due Date 2021"